Build Fuel Cell Cost Models You Can Defend

Product Managers cannot make strategic bets on PEM, SOFC, SOEC, Alkaline or AEM when the inputs behind cost curves do not align.

By Erhan Eren

Updated 1 December 2025

Why fuel cell cost models fail

Most cost models collapse because the data comes from incompatible sources.

What actually drives fuel cell costs

- Membrane material and durability

- Catalyst loading and precious metal content

- Bipolar plate manufacturing

- Sealing and assembly complexity

- Compressors and blowers

- Heat exchangers and thermal management

- Power electronics and inverters

- Piping, valves, and controls

- Production volume and learning curves

- Supply chain maturity

- Quality assurance and testing

- System integration complexity

- Fuel purity requirements

- Maintenance intervals and parts replacement

- Degradation rates and stack lifetime

- Cooling and auxiliary power consumption

Understanding fuel cell technology costs

| Technology | Operating Temp | Efficiency | CAPEX Range | OPEX | Key Applications |

|---|---|---|---|---|---|

| PEM | 60–80°C | 40–60% | $3,000–5,000/kW | Low | Transportation, backup power |

| SOFC | 800–1000°C | 50–65% | $4,000–6,000/kW | Medium | Stationary power, CHP |

| SOEC | 800–1000°C | 70–90% | $5,000–8,000/kW | Medium | Green hydrogen production |

| Alkaline | 60–90°C | 50–70% | $2,000–4,000/kW | Medium | Industrial hydrogen |

| AEM | 50–80°C | 45–65% | $3,500–5,500/kW | Low | Emerging, flexible applications |

CAPEX ranges vary significantly by region, manufacturing scale, and system integration. These ranges reflect 2024 market data from deployed systems.

The modern workflow replaces guesswork with evidence

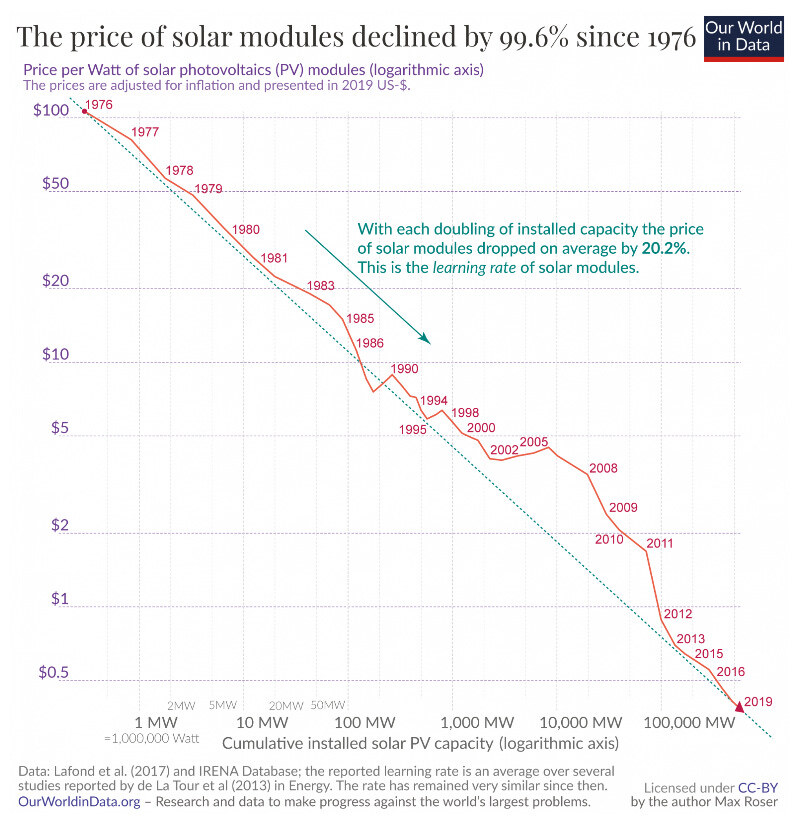

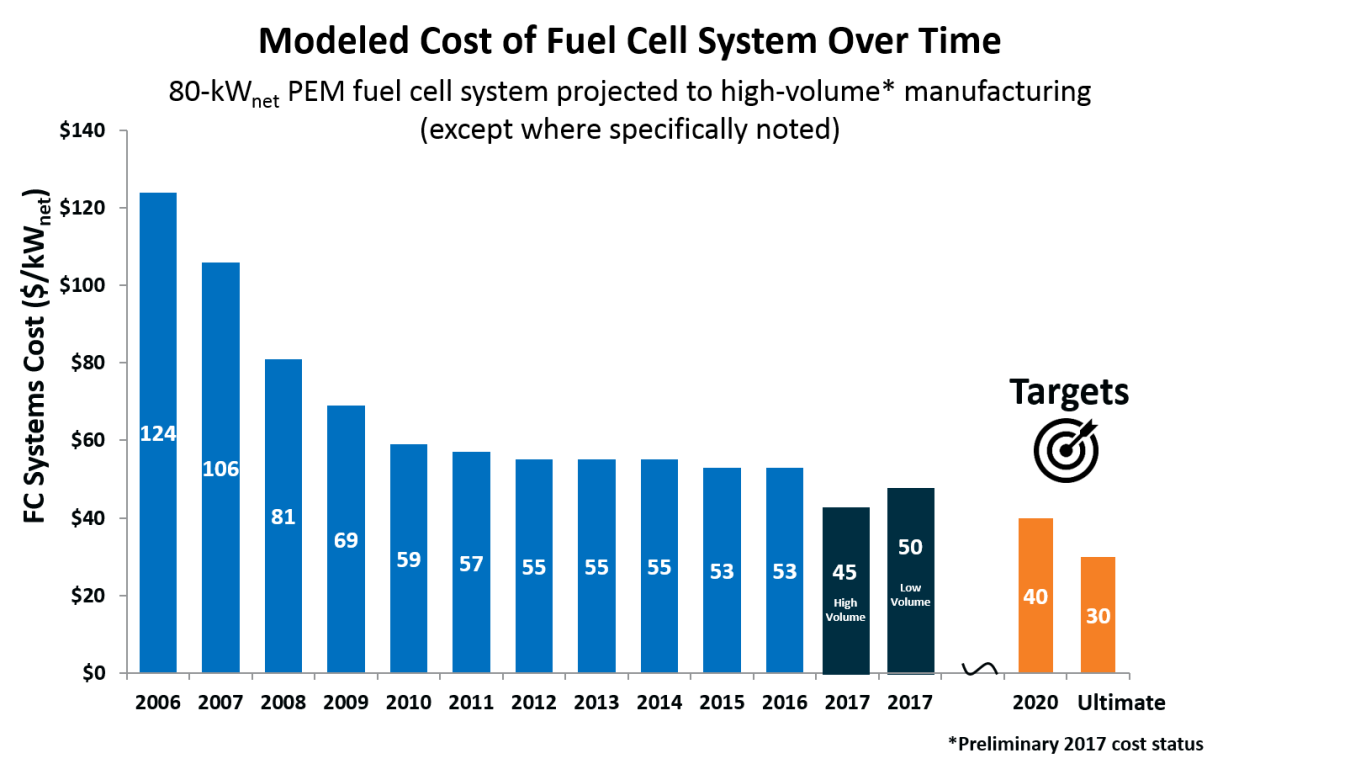

Learning curves: How manufacturing scale drives cost reduction

Create a detailed analysis:

Historical learning rates (2015-2024)

- PEM: 8-12 percent cost reduction per doubling of cumulative production

- SOFC: 5-8 percent cost reduction per doubling

- Alkaline: 6-10 percent cost reduction per doubling

- SOEC: 10-15 percent cost reduction per doubling (early stage)

- AEM: 12-18 percent cost reduction per doubling (emerging technology)

Current production volumes and trajectory

- PEM: ~50,000 units/year globally → projected 500,000 by 2030

- SOFC: ~5,000 units/year → projected 50,000 by 2030

- Alkaline: ~10,000 units/year → projected 100,000 by 2030

- SOEC: ~1,000 units/year → projected 50,000 by 2030

- AEM: less than 500 units/year → projected 10,000 by 2030

Cost reduction potential (2024-2030)

- PEM: 30-40 percent reduction expected

- SOFC: 20-30 percent reduction expected

- Alkaline: 25-35 percent reduction expected

- SOEC: 40-50 percent reduction expected

- AEM: 50-60 percent reduction expected

Lifetime and degradation: The hidden cost driver

PEM Fuel Cells

- Typical lifetime: 5,000–10,000 hours

- Degradation rate: 2–5 percent per 1,000 hours

- Primary failure modes: Membrane thinning, catalyst poisoning, corrosion

- Replacement cost: 30–40 percent of initial stack cost

SOFC

- Typical lifetime: 40,000–80,000 hours

- Degradation rate: 0.5–2 percent per 1,000 hours

- Primary failure modes: Electrolyte cracking, interconnect oxidation

- Replacement cost: 25–35 percent of initial stack cost

SOEC

- Typical lifetime: 20,000–40,000 hours (emerging data)

- Degradation rate: 1–3 percent per 1,000 hours

- Primary failure modes: Oxygen electrode degradation, electrolyte densification

- Replacement cost: 35–45 percent of initial stack cost

Alkaline

- Typical lifetime: 10,000–20,000 hours

- Degradation rate: 1–4 percent per 1,000 hours

- Primary failure modes: Electrode corrosion, electrolyte decomposition

- Replacement cost: 25–30 percent of initial stack cost

AEM

- Typical lifetime: 5,000–15,000 hours (limited field data)

- Degradation rate: 2–6 percent per 1,000 hours

- Primary failure modes: Membrane degradation, ionomer stability

- Replacement cost: 30–40 percent of initial stack cost

Degradation rates vary significantly based on operating conditions, fuel purity, and thermal cycling. These ranges reflect best-case scenarios with optimized operation.

CAPEX varies dramatically by

region and deployment context

North America

PEM: $4,000–5,500/kW

SOFC: $5,000–7,000/kW

Drivers: Mature supply chain, high labor costs, established OEMs

Europe

PEM: $3,500–5,000/kW

SOFC: $4,500–6,500/kW

Drivers: Green hydrogen incentives, strong manufacturing base, policy support

Asia-Pacific

PEM: $2,500–4,000/kW

SOFC: $3,500–5,500/kW

Drivers: Lower manufacturing costs, rapid scaling, emerging players

Emerging Markets

PEM: $3,000–4,500/kW

SOFC: $4,000–6,000/kW

Drivers: Limited local production, import costs, early deployment phase

Regional costs reflect 2024 data from commercial deployments. Prices decline 5–8 percent annually as manufacturing scales.

ENKI supports this process by surfacing cost signals, aligning assumptions and revealing changes months before mainstream reports

Surface cost signals

Real deployments, actual filings, efficiency data, degradation evidence, supply chain movements. Not forecasts.

Align assumptions

Normalize CAPEX, OPEX, lifetime and degradation across PEM, SOFC, SOEC, Alkaline and AEM. Compare apples to apples.

Reveal changes early

Spot cost inflection points months before they appear in published reports. Stay ahead of the market.

Real-world fuel cell cost modeling scenarios

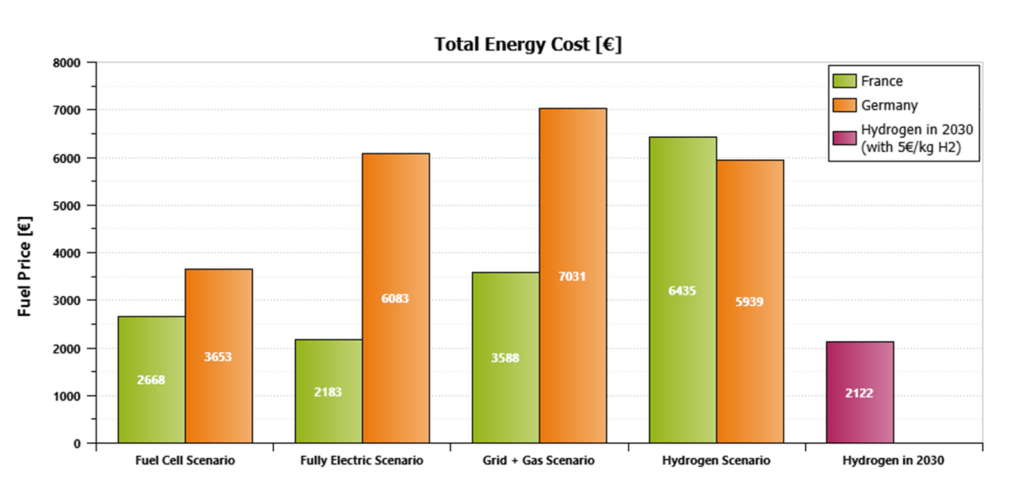

Transportation fleet electrification

Decision: Should we deploy PEM fuel cell buses or battery electric buses?

ENKI analysis: Compare total cost of ownership (CAPEX + OPEX + fuel) over a 10-year lifecycle.

- Hydrogen fuel costs, electricity prices, maintenance intervals, residual value.

Outcome: Identify breakeven hydrogen price and deployment timeline.

Industrial hydrogen production

Decision: Build an alkaline or SOEC electrolyzer for green hydrogen?

ENKI analysis: Model CAPEX, electricity costs, degradation, and production efficiency.

- Electricity price, capacity factor, stack replacement cycles.

Outcome: Calculate levelized cost of hydrogen (LCOH) under different scenarios.

Stationary power and CHP

Decision: SOFC or natural gas generator for backup power?

ENKI analysis: Compare installed cost, fuel efficiency, maintenance, and reliability.

- Natural gas prices, electricity rates, thermal demand, grid reliability.

Outcome: Determine payback period and optimal system size.

Technology roadmap planning

Decision: Which fuel cell technology should we invest in for 2030?

ENKI analysis: Project cost trajectories, learning curves, and market adoption.

- Manufacturing scale, technology breakthroughs, policy support.

Outcome: Identify highest-potential technology and investment timing.

Market sizing and TAM

Decision: What is the addressable market for fuel cells in our region?

ENKI analysis: Model deployment potential across applications and geographies.

- Cost competitiveness, policy incentives, infrastructure readiness.

Outcome: Build defensible TAM/SAM/SOM for strategic planning.

Each scenario is built with transparent assumptions, cited data, and probability ranges. You can pressure-test your decisions against different market conditions.

How ENKI builds defensible fuel cell cost models

Primary data sources

- Company filings: Annual reports, investor presentations, earnings calls

- Deployment databases: Installations, capacity additions, performance data

- Supply chain intelligence: Material costs, manufacturing capacity, lead times

- Research publications: Efficiency, degradation, lifetime studies

- Patent filings: Technology roadmaps and innovation signals

Data normalization process

- Standardize CAPEX across sizes/configurations

- Adjust for regional cost variations and currency effects

- Account for balance-of-plant and integration differences

- Normalize OPEX assumptions to consistent operating conditions

- Resolve conflicting data using triangulation

Scenario modeling

- Base case: Conservative assumptions, technology maturity

- Optimistic case: Faster learning curves, breakthroughs

- Pessimistic case: Supply chain constraints, slower adoption

- Policy scenarios: Subsidies, carbon pricing, regulation impacts

Validation and updates

- Monthly tracking of deployments and cost announcements

- Quarterly learning-curve recalibration

- Annual review of technology roadmaps and R&D progress

- Cross-checking against published analyst reports

- Consistency checks through multi-source validation

Every cost estimate in ENKI is backed by specific sources. You can drill down to see the underlying data, assumptions, and citations.

If you need a cost model that engineering, finance and leadership can trust, begin with evidence not forecasts.

Start building defensible fuel cell cost models today. See how ENKI transforms scattered data into strategic clarity.