The Real Drivers Behind the AI Power Boom (Not What Headlines Say)

AI’s power future is not shaped by GPUs. It is shaped by grid filings, procurement signals and infrastructure behavior that becomes visible long before announcements.

By Erhan Eren

Updated 23 November 2025

.png?width=1024&height=1024&name=Gemini_Generated_Image_pdsodspdsodspdso%20(1).png)

Most headlines blame GPUs for the AI energy surge.

The real forces shaping AI’s future are not in chip supply chains.

They are in:

- Grid constraints

- Transmission queues

- Power procurement behavior

- Behind-the-meter generation

- Cooling limitation

- Water availability

These signals move months before any company acknowledges them.

This article reveals where AI power growth is actually emerging and how to identify the earliest indicators using ENKI.

If you want to understand where AI power demand is heading, ignore GPU shipments.

- Interconnection queues

- Early PPA Activity

- Substation expansion schedules

- Behind the meter projects

- Water and cooling restrictions

These are the true leading indicators of where AI clusters will appear or stall.

Headlines describe the consumption.

Signals reveal the direction.

Why AI Power Demand Is Changing Faster Than Expected

AI is not limited by GPUs. It is limited by grid constraints, power procurement behavior and hidden infrastructure pressures. These forces appear in public signals long before companies acknowledge them.

The Hidden Forces Behind AI Power Growth

Growth does not start with announcements. It starts with behavior that shows where capital, customers, and suppliers are moving next.

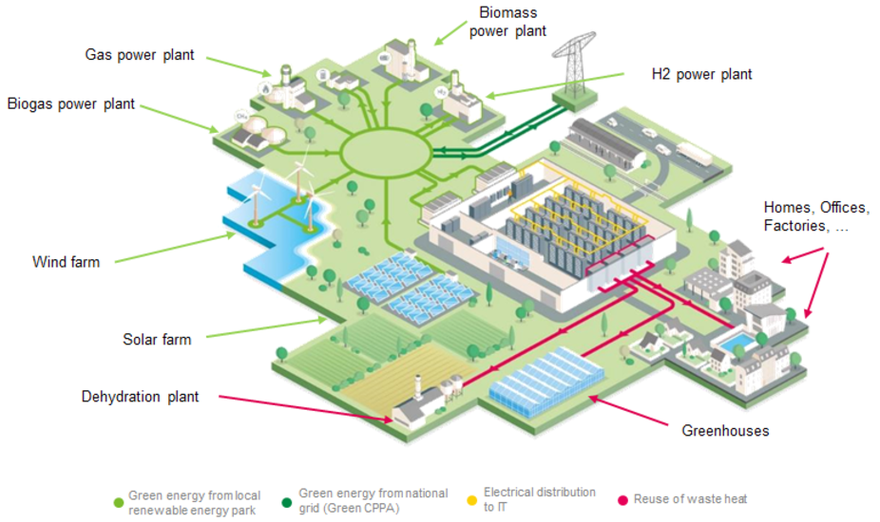

Microgrids, turbines and fuel cells are replacing waiting for grid headroom.

The Grid Is Becoming the Bottleneck

Signal to watch

-

States quietly turning away new datacenter load

-

Queue timelines stretching to five to eight years

-

Utilities issuing demand spike warnings

-

Early project delays pointing to shortages in 2026 to 2028

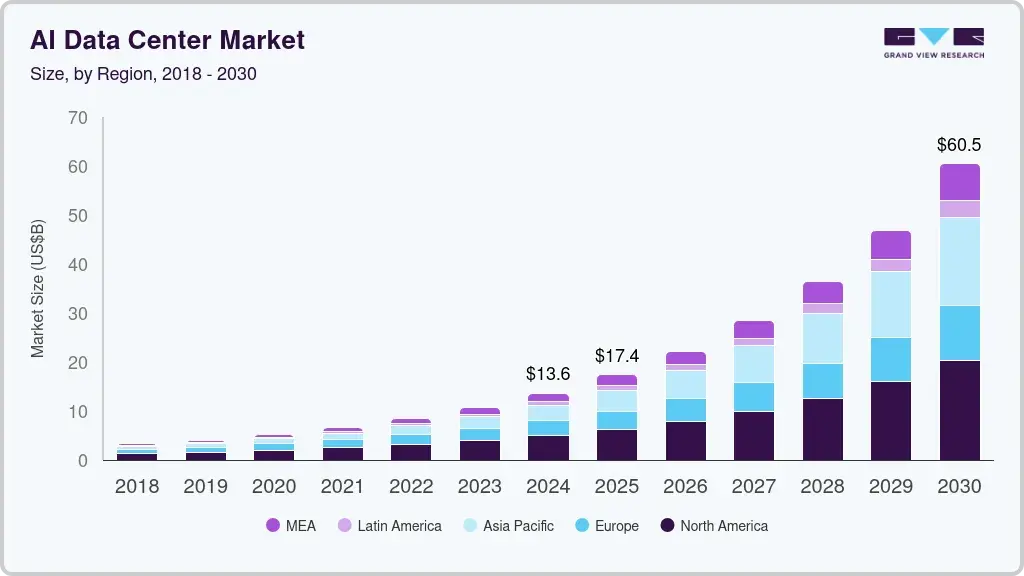

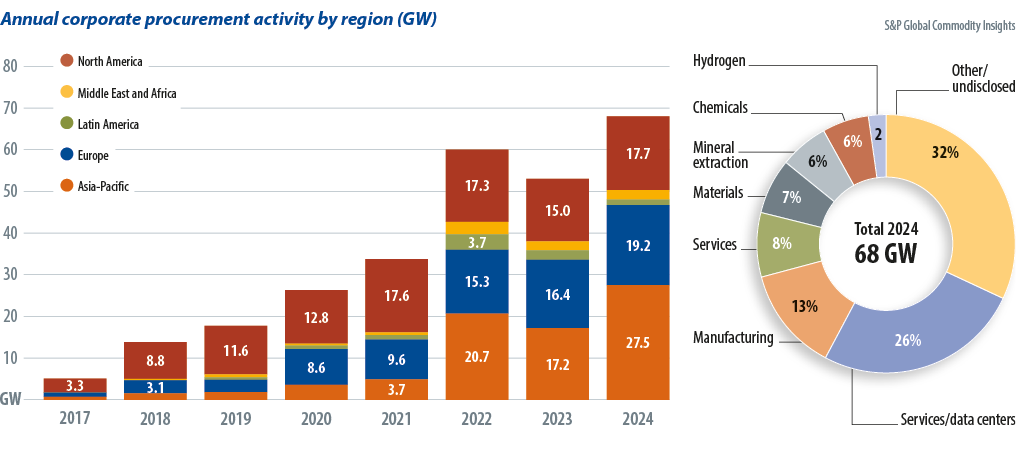

PPAs Reveal Where AI Capacity Will Grow

Signal to watch

-

Multi gigawatt PPAs quietly signed by hyperscalers

-

Regions attracting far more PPAs than others

-

PPA timing exposing early grid stress

-

A small group of developers capturing most supply

Behind-the-Meter Generation Is Becoming Standard

Signal to watch

-

Shift from grid-dependent to grid optional designs

-

Fuel cell deployments are increasing

-

Hydrogen turbines are used as backup and peaking power

-

SMR feasibility studies resurfacing

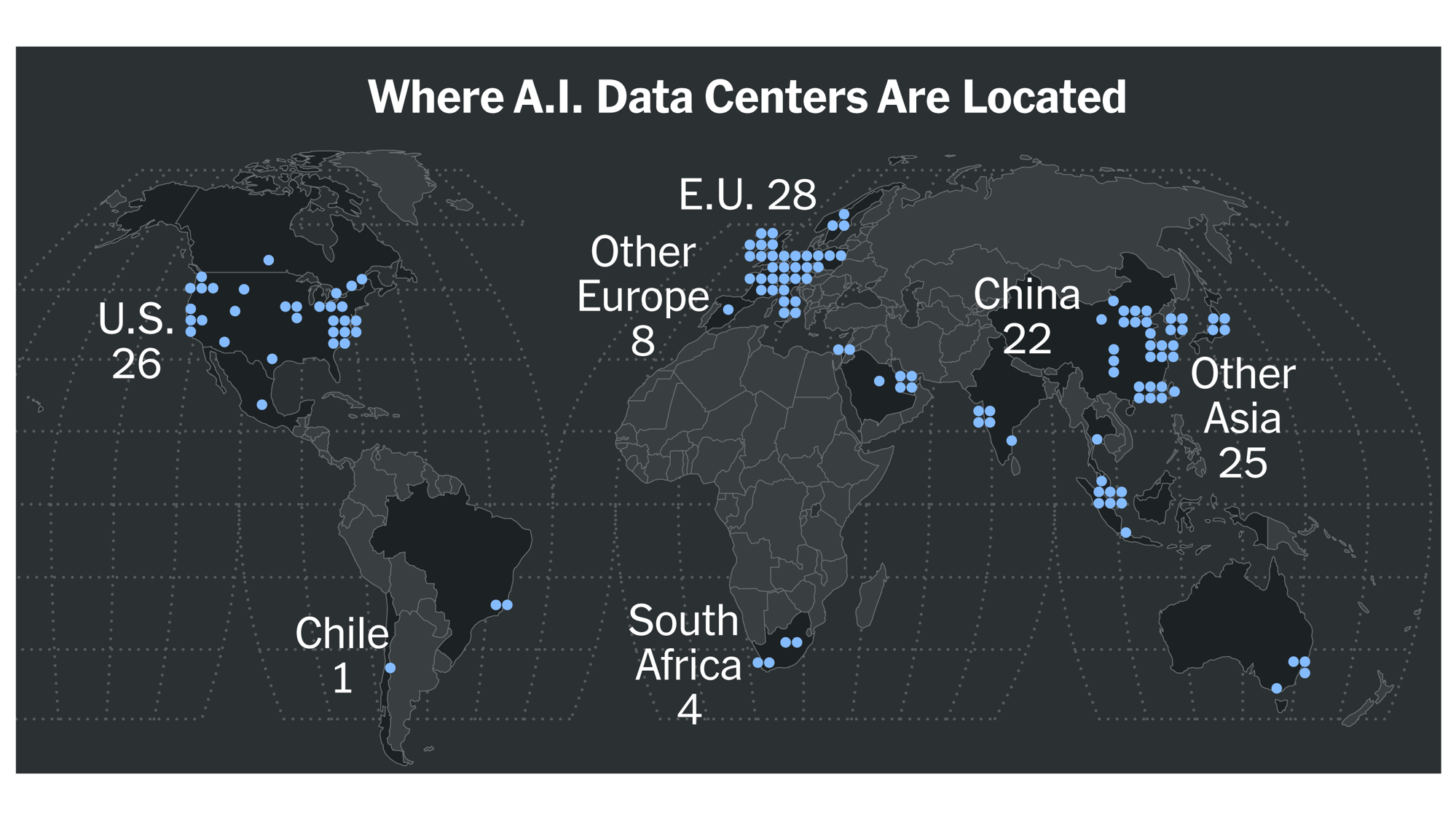

Where AI Power Growth Is Actually Visible

AI load does not start with GPU shipments or press releases.

It begins with the subtle signals that indicate where infrastructure can support the next wave of computing.

These four movements show the earliest places where AI growth will accelerate or stall.

Substation and Transmission Buildouts Are the New Arms Race

• Substation lead times are increasing from 18 months to five years.

• Transmission congestion stalling metropolitan growth.

• Utilities prioritizing hyperscaler load.

• Regions preparing AI-ready expansion plan.

Which utilities are expanding substations and transmission lines?

Where are the largest upgrades happening?

.png)

Water and Heat Are Becoming the Silent Constraints

• Water use restrictions emerging across states

• Liquid cooling changing facility design

• Waste heat becoming a negotiation point

• Environmental reviews blocking large projects

Where are data centers facing water or cooling constraints?

Show new cooling technologies and municipal decisions.

.png)

A New Set of Energy Winners Is Emerging

• Engineering firms winning hyperscale contracts

• Fuel cell companies gaining traction

• Hydrogen developers entering the datacenter market

• Power equipment suppliers shifting to AI-focused offerings

Which suppliers and infrastructure firms are gaining traction?

Where is AI-focused expansion accelerating fastest?

Where AI Load Will Break the Grid First

• Regions below safe reserve margins

• Limited transmission headroom

• Markets where AI demand adds >15% load

• Areas where the new generation cannot be built fast enough

Run scenarios: 1, 5, 10 GW of new AI load.

Identify regions with the highest risk.

View stress scenarios

The Double-Edged Challenge: AI’s Power Footprint

Data centers power the digital economy, but they also strain electricity supply, cooling systems and local infrastructure. Understanding the early signals behind this growth helps teams identify opportunities before the window closes.

Regions with thin reserve margins will face the earliest failures.

Three Pathways to Understand AI Power Growth

Grid and interconnection filings always move first.

Stay Ahead of Data Center Movement

Follow our deep market analyses and signal driven insights to track where new opportunities are forming.

What You’ll Gain Here

By engaging with our content, you'll gain a clear understanding of AI’s realistic capabilities and limitations within the energy sector. Discover inspiration from companies at the forefront of the AI-energy revolution and acquire the tools to contribute meaningfully to energy transition conversations. Empower your knowledge and perspective.

Clear Insights

Real signals shaping AI’s energy future.

Industry Perspective

What hyperscalers and utilities are doing before announcements.

Practical Tools

The ENKI queries to track these signals in real time

Ready to See the Real Signals Behind AI Power?

Dive into early signal analysis and see where the next wave of global expansion is forming.